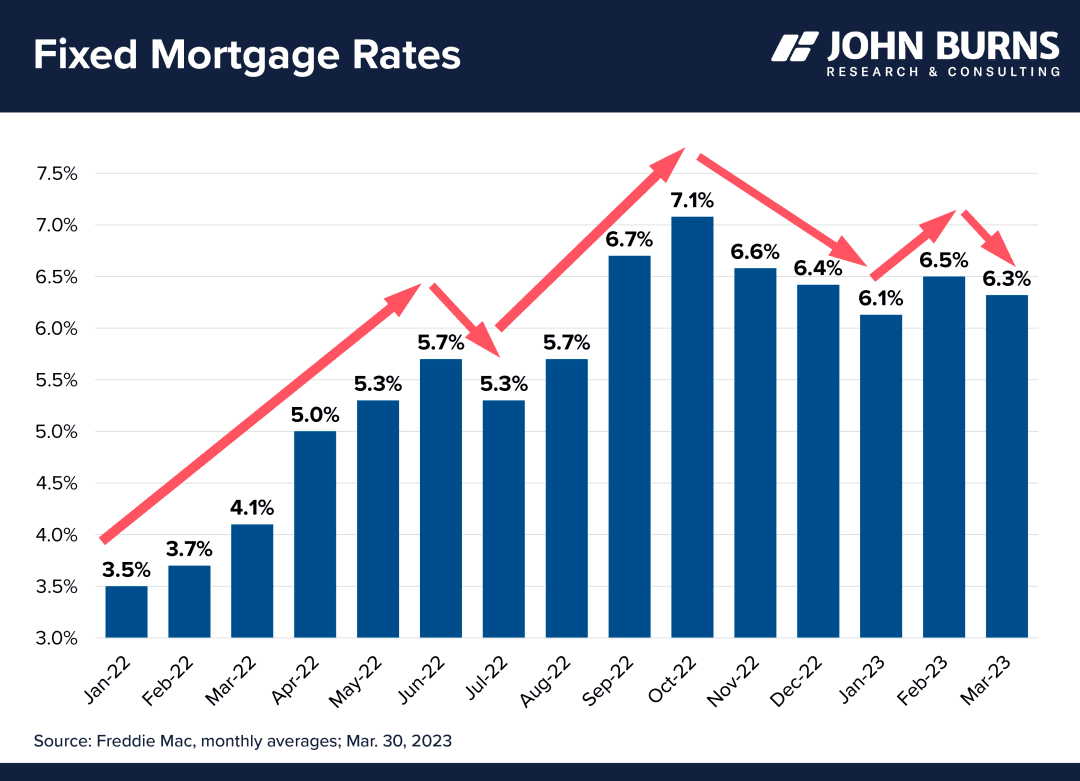

Changing mortgage rates have significantly impacted homebuying demand over the past 15 months, showing a cyclical relationship between mortgage rates and sales trends.

Historically, the ebb and flow of these rates have been tied to broader economic forces, from inflation to national fiscal policies. But what exact rate sparks significant behavioral change among potential homebuyers? A research team at John Burns Research and Consulting, has determined a “magic mortgage rate” that seems to be the tipping point for many homebuyers. But why is the specific rate they found so significant? Let's unpack the data and insights behind the research and explore its transformative impact on homebuying behaviors.

The Rise and Fall of Mortgage Rates: How it Affects Homebuying Trends

Rising rates between January and June of last year led to a slowdown in sales, which improved during the summer as rates fell. Conversely, spikes in rates during September and October resulted in poor sales during the fourth quarter. Demand is inversely related to payment amounts – as mortgage payments decline, demand for homes increases, and vice versa.

So what is the magic mortgage rate that appears to dissolve financial barriers for potential homebuyers? The key threshold from the research conducted by the New Home Trends Institute demonstrates that 5.5% seems to be the pivotal tipping point for mortgage rates. Consumers' perception of a historically normal mortgage rate being below 5.5% aligns with 71% of prospective home buyers who are unwilling to accept a mortgage rate above this percentage.

Essentially, homebuilders are most successful when they’re able to bring mortgage rates below 5.5%, with some of the largest builders achieving rates below 5.0%. This strategy, combined with factors like falling construction costs and the lack of competition from the resale market, has contributed to the positive performance of homebuilders.

Another crucial factor contributing to homebuilder success is the ability to market to the right clients. Targeting the right audiences with specialized content, establishing relationships with clients, and taking advantage of the latest technology are all key considerations as a home builder.

Working With the Right Brokerage Makes All the Difference

In this dynamic and often tumultuous real estate climate, it’s more important than ever as a homebuilder to showcase to your clients that you have the expertise to find their dream home with the mortgage rate that works for them. Establishing trust with homebuyers is paramount. You want to empower potential homebuyers to make decisions that benefit everyone involved and establish the relationship necessary to do that.

PresGroup is a leading and unique player in the real estate sales and marketing industry. As the only fully integrated company of its kind, we combine expertise and cutting-edge technology to deliver exceptional results to our clients. With a team of seasoned professionals dedicated to achieving profitable outcomes, we take a transparent and straightforward approach.

Our all-inclusive packages cover every aspect of sales and marketing campaigns for homebuilders, from initial strategy development to final execution. By leveraging the latest talent and industry know-how, we create impactful campaigns that resonate with your target audiences, ultimately driving sales and nurturing lasting relationships.

Let us empower your homebuyers with insightful, educational content. With PresGroup, you can help them make confident, informed decisions, even amidst market uncertainties. Reach out and start building trust with potential homebuyers today!